A Swift Introduction to Profit and Loss Statement

The profit and loss statement (P&L) is an important look at a business’s financial standing, which public companies issue both quarterly and annually. This article will provide a detailed breakdown of the profit and loss statement, including what it covers and the intended purpose. You’ll learn the difference between this type of statement and other financial statements companies issue.

Such statements include balance sheets and cash flow statements. Finally, it will include an example of items you may see on these statements and how you can analyze the information on them. And, finally, why it’s important to look at several of a company’s statements over a period of time to fully understand its financial situation.

What is a Profit and Loss Statement?

A P&L statement is a record of a company’s revenue and expenses over a set period of time, typically the fiscal quarter, if it’s a quarterly statement, or the fiscal year if it’s an annual statement. There are several other names for P&L statements, including statements of profit and loss, income statements, statements of financial results, income and expense statements, and statements of operations, but they all refer to the same thing.

While documents similar to the P&L statement have been around for centuries, the version known today first appeared in the early 20th century, when the Federal Reserve set standards on financial statements for companies. A P&L statement essentially demonstrates how a company turns its revenue into its net income. Both investors and creditors use these statements to look at a company’s financial situation. Investors to see if they will invest in the company, and creditors to determine if the company is credit-worthy.

The law requires all public companies to prepare P&L statements. These statements demonstrate whether the company made or lost money over the indicated period of time. Keep in mind that, since these statements represent a period of time, it’s important to not overestimate the importance of any one P&L statement and instead compare multiple statements.

A Detailed Account of Profit and Loss Statements

1

There are two ways an accountant can prepare a P&L statement: the Single Step method and the Multi-Step method, with the former being much simpler and the latter providing more information. The Single Step method involves, first, calculating the company’s revenues during a time period. Then subtracting all its expenses to determine the net income.

The Multi-Step method instead takes the company’s gross profit and subtracts its operating expenses to determine its income from operations. It then takes the difference between any other revenues and other expenses. It adds that amount to the income from operations to determine the income before taxes. Deducting taxes from that amount determines the net income.

2

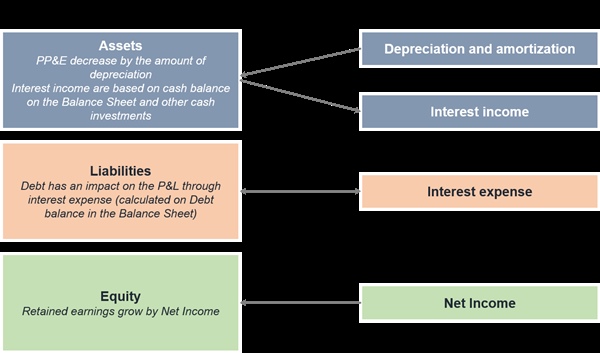

Companies issue balance sheets and cash flow statements with P&L statements. A balance sheet breaks down the company’s assets, liabilities, and shareholders’ equity. Unlike a P&L statement, a balance sheet is a snapshot from one point in time. A cash flow statement focuses on a period of time, like a P&L statement, and it has information on all the cash flow a company received during that time period, as well as the cash it had to spend.

By looking at a company’s P&L statements, you can figure out what kind of shape the company is in financially. Obviously, any one P&L statement can show you whether the company made money during that period and, if so, how much. However, it’s better to look at multiple P&L statements to see how the company’s numbers are changing over time. This allows you to get a better understanding of how the company is progressing or regressing. And, of course, you can see whether the company is likely to be successful in the long term.

A company may have a high amount of revenue on its P&L statement, and its revenue may have grown over previous P&L statements. That doesn’t necessarily mean it’s doing well, particularly if its expenses are increasing even more quickly, which is why it’s important to look at the data available over multiple P&L statements.

Examples of Profit and Loss Statements

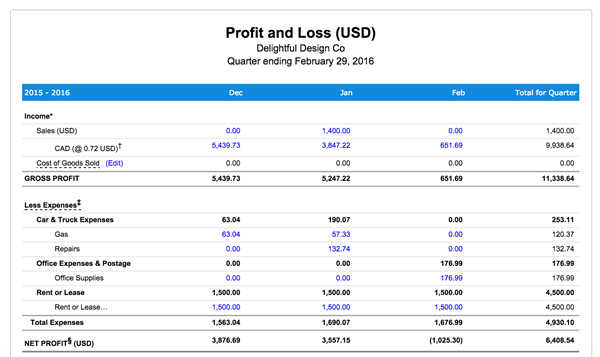

What can you expect to see on a Profit and Loss statement? Let’s use a hypothetical Company A as an example. Its P&L statement will list the time period covered at the top, such as 2016. Beneath that, it will have the company’s sales and revenues split into two categories. These are whatever revenue categories that company has and the individual totals for each category.

Total sales and revenues will be at the bottom. So, if the company had one sales category with 40,000 and a revenue category with 10,000, it would list its total sales and revenues at 50,000.

Profit and Loss statement of Company A

Company A will list its operating costs for any expense categories it has. Those categories are the cost of goods sold, administrative expenses, marketing, and miscellaneous expenses. It will combine those into the total operating costs at the bottom. The difference between the total sales and revenues and the total operating costs determine the next line on the statement. This statement line is the company’s operating profit.

Through the rest of the statement, the company will list other expenses. They are income, interest expenses, profit before taxes, and its profit per share.

You can line up multiple P&L statements side by side to easily compare all the company’s numbers from year to year, or quarter to quarter. To get an idea of how this looks, you can check out Caterpillar Inc’s P&L statements for 2013 and 2014, which are available on Investopedia.

How much you can analyze a company’s P&L statements depends on how well you know the company’s industry. Generally speaking, this way you can get an idea of which direction the company is headed. You have to look at its revenue and operating costs.

Of course, the ideal scenario is that revenue goes up while operating costs remain stable or go down. However, it is far more likely for both to either go up or down. Another important factor is the company’s interest expenses. If those go up, it means the company’s debt may be increasing. You can confirm this by looking at Companny A’s balance sheet.

Conclusion

The Profit and Loss statement is a set of useful pieces of information that can help you determine if a company is headed in the right direction. To get the clearest picture of a company’s financial situation and how it’s progressing, you should look at several P&L statements, along with its balance sheets and cash flow statements. Doing so can show you if a company is primed for success or failure.

We’ll release another article on P&L statements to provide you with even more information on the subject. Do you have any experience regarding P&L statements, or do you have any questions about them? Discuss them with us in the comments.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

As a participant in the Amazon Services LLC Associates Program, this site may earn from qualifying purchases. We may also earn commissions on purchases from other retail websites.

Find us on Facebook

Recent Posts

- Forex Indicators: 4 Indicators Investors Should Know

- Best Money Clip: 10 Options to Secure Your Cash

- What is a Savings Account? Explaining Why You Should Have One

- Clarity Money Review: A One-Stop-Shop

- What Do Investment Bankers Do? Ultimate Guide

- Top 10 Best Investing Books

- Best Bitcoin Mining Software: Top 5 Revealed

- Depreciation Methods: Our Top 4 Picks

Leave a Reply