The Basics of Portfolio Diversification

Investing involves taking a risk to make money, but there is also a risk of losing money. There is no way to eliminate the possibility of losing money, but you can develop strategies to help minimize monetary losses that you will experience. The primary way to do this is through diversifying the investments in your portfolio. For decades, the concept of portfolios and diversification has helped investors survive economic downturns by limiting financial losses. What is portfolio diversification is easy to understand and implement, and it’s used by everyone from novice investors to hedge fund managers.

What is Portfolio Diversification?

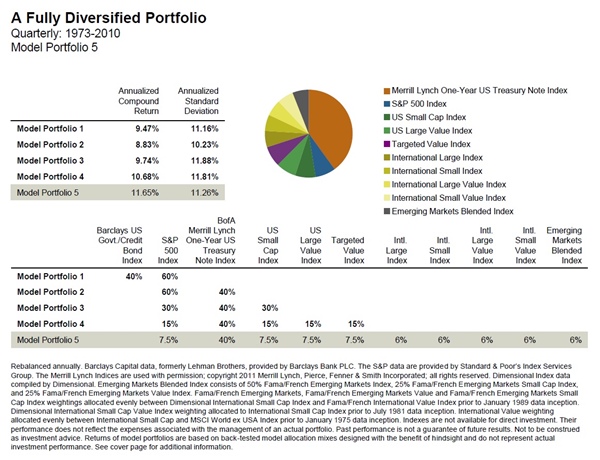

The theory behind portfolio diversification was developed in 1952 by Harry Markowitz. His approach to diversification was to create a portfolio that has low-risk assets along with assets that provide maximum returns. The goal is to have an efficient portfolio that can obtain the best returns no matter what the risk level happens to be under constantly changing market conditions. In creating this type of portfolio, you would start by making conservative investments in bonds or Treasury bills, then make more aggressive investments that can achieve higher returns.

Other theories of portfolio diversification have developed since Harry Markowitz’s original theory. These theories include:

The post-modern portfolio theory – this theory is an aggressive approach to investing in which an asset must have the ability to earn a minimum rate of return to be included in a portfolio. The best assets are the ones that have high rates of return.

- The risk parity theory – this type of portfolio includes stocks, bond, and gold, based on their price volatility. Each asset class should have the same level of price volatility so that one class doesn’t dominate another class.

- The maximum diversification theory – this theory is like risk parity theory. Using a mathematical calculation, the risk of the portfolio should be less than the risk of the individual assets. In addition to stocks, bonds, and gold, this type of portfolio includes real estate, artwork, and commodities.

- These theories are complex and involve mathematical calculations, but basic portfolio diversification doesn’t have to be complex to be effective.

A Detailed Account of Portfolio Diversification

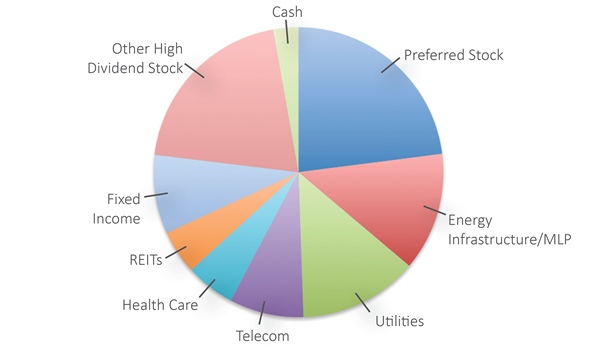

There are many ways you can diversify your portfolio without calculating mathematical formulas. You can choose to invest in a mix of assets such as stocks, bonds, precious metals, commodities, real estate, futures contracts, and options. Any combination of two or more of these asset classes will work, but the most common mix of assets in a diversified portfolio is to have a combination of stocks and bonds. This is because stocks and bonds have a negative correlation to each other, which means when the broader stock market is up, the broader bond market is down and vice versa.

Diversification can also occur within one asset class. This commonly occurs with stocks where you can diversify your stock portfolio with foreign, domestic, small cap, mid cap, and large cap stocks. Stock portfolios can also be diversified by industries like pharmaceuticals, energy, telecommunications, consumer goods, automotive, and retail. The easiest way to have a diversified stock portfolio is to invest in index funds that invest in a mix of stocks across many different industries.

Examples of Portfolio Diversification

Another way of creating a diversified portfolio is through asset allocation. If you decide to work with a financial planner, the planner may give you an evaluation to get an idea of your risk tolerance. Based on your risk tolerance, your financial planner will create an investment strategy that complements your tolerance level.

Tolerance levels can range from conservative to aggressive. An older client with a short time horizon looking for passive income and to preserve capital may be a conservative investor. A younger client with a long-time horizon, looking for rapid capital growth, may be a more aggressive investor.

A)

For example, someone who is 60 years old, who is looking to retire five to seven years, and has $500,000 in investments may have a diversified portfolio allocation that looks something like this:

- 40% invested in large-cap stock index funds or mutual funds, or in individual stocks like Walmart, Disney, and Microsoft;

- 58% in Treasury bills, corporate bonds, or municipal bonds;

- 2% cash in a money market account or a Certificate of Deposit.

B)

A diversified portfolio allocation for a 30-year-old with $10,000 to invest may look something like this:

- 70% invested in individual stocks, index funds or mutual funds in small-cap and mid-cap companies that have rapid growth potential;

- 29% in Treasury bills, corporate bonds, or municipal bonds;

- 1% cash in a money market account or a Certificate of Deposit

An easy way to know how to allocate assets within a portfolio is through calculation. It is as follows: taking the number 100 then subtracting your age. This will give you a percentage number of how much stock should be in your portfolio.

For instance, if you are 43-years old, you should have a portfolio with 57% of the money within the stocks. Then, one to two percent of the money should be held in cash you can access in the event of an emergency. And the remaining money should be placed in Treasury bills or bonds.

Another suggestion comes from the great investor Warren Buffet, who says that 90% of your money should be invested in an S&P 500 index fund, and 10% should be placed in government bonds. Besides, asset allocation strategies are not law. It is up to you to find a strategy that you are comfortable with and implement your plan.

Conclusion

The concept of portfolios and diversification helps reduce the risk of volatility in your portfolio. However, it does have a limitation. For instance, a diversified portfolio can help you minimize losses. But it can also prevent you from maximizing gains, because your money may spread too thin across multiple investments.

In this situation, you should continue to monitor your portfolio, recognize positive and negative trends in your investments. In addition, you can make trades within your portfolio to reallocate assets to more profitable investments. Another article will be coming soon, so feel free to share your experiences, thoughts, and questions on this subject.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

As a participant in the Amazon Services LLC Associates Program, this site may earn from qualifying purchases. We may also earn commissions on purchases from other retail websites.

Find us on Facebook

Recent Posts

- Forex Indicators: 4 Indicators Investors Should Know

- Best Money Clip: 10 Options to Secure Your Cash

- What is a Savings Account? Explaining Why You Should Have One

- Clarity Money Review: A One-Stop-Shop

- What Do Investment Bankers Do? Ultimate Guide

- Top 10 Best Investing Books

- Best Bitcoin Mining Software: Top 5 Revealed

- Depreciation Methods: Our Top 4 Picks

Leave a Reply