It’s easy to see all cheap stocks as attractive. After all, who wouldn’t want to make a massive return on their initial investment?

Take penny stocks, for example. With penny stocks, it’s possible to see profits in excess of 100% practically overnight. A stock valued at $0.50 one day might trade for $1.00 the next day due to a positive earnings report or some other news.

But that’s not usually how it works. The bigger the potential gains, the bigger the potential pitfalls. This is a sound concept in almost any arena. “Easy come, easy go,” as the old saying goes.

One of the most common and costly mistakes investors make is falling into a value trap. A value trap is a company that faces a severe decline in their fundamentals. Even stocks that appear to be good values at the moment can wind up tanking if the company in question has been seeing its earnings decline over the long term.

There are different kinds of cheap stocks. Most people think of cheap stocks as penny stocks that have a very small share price. But there are also cheap dividend-yielding stocks.

Dividend-yielding stocks are stocks that you hold for long periods of time due to the dividends they pay out on a regular basis. If you can find stocks that yield high dividends at a fair share price, you can make a handsome profit with relatively little risk.

On the other hand, penny stocks come with a lot of risks. Defined as cheap stocks that are valued at under $5, penny stocks represent shares in smaller public companies that don’t have enough market capitalization to be listed on the major global exchanges.

Dividend-Yielding And Penny Cheap Stocks

Here are the top 10 best cheap stocks of 2018.

Note that while the first five are penny stocks, the others are dividend-yielding stocks. Summaries of the penny stocks include technical analysis, while summaries of the dividend stocks include fundamental factors.

This is because when a stock pays dividends, an investor has no reason to inquire about the technical chart of a stock since they will be holding shares long-term and receiving dividends regardless of price performance.

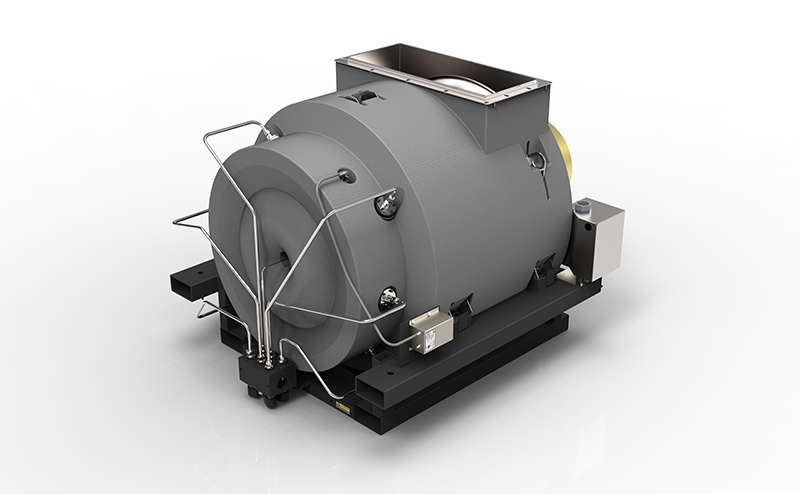

1.) Capstone Turbine Corporation (CPST)

Capstone Turbine shares approached their record low of $10.20, set back in 2002, in March 2009. Since then, the stock has bounced back into a significant uptrend that reached its peak in 2014, being valued at over $50. The stock began to fall and broke its long-term support level in 2015, leading to a downtrend that resulted in a new record low of just $0.58 in September 2017.

2.) Vivint Solar, Inc. (VSLR)

Vivint Solar went public in 2014 when its share price was close to $17.00. Shortly thereafter, the stock entered a downtrend that reached a record low of $2.16 in May 2016. It traded sideways for some time before turning higher, peaking at $6.09 in June.

3.) Senseonics Holdings, Inc. (SENS)

Shares of SENS reached as high as $4.24 in 2016 before trending downwards to a record low of $1.26 in May of the following year. Upon reaching that low, the stock then recovered all the way to $3.67 in October. Going into June 2018, a cup and handle breakout pattern completed, leading to a sharp rise to a record high of $5.29. A pullback has since initiated.

4.) Denbury Resources Inc. (DNR)

Shares of Denbury Resources reached an all-time high of $40.32 in June 2008 and cratered in sync with global markets, hitting a three-year low at $5.59. The stock reached a lower high in 2011 before another serious fall to an 18-year low in 2016. DNR tested that low in September 2017, but this time rebounded strongly, entering an uptrend that reached the resistance level of $4.80 in May 2018.

5.) Cerecor Inc. (CERC)

Cerecor went public in November 2015 at a price of $4.95 and quickly fell into a range with support close to $2.70 with resistance at $5.00. The stock entered freefall in Q4 2016, beginning a steep decline that reached an all-time low in April 2017 at just $0.34. But the stock bounced back in late 2017 and the first half of 2018, finally reaching the resistance level established back in 2016.

6.) Big 5 Sporting Goods Corp (NASDAQ: BGFV) – 10.1% Yield

As you may already know, Big 5 is a sporting goods retailer. As of Q1 2017, the company operated 431 stores in addition to an e-commerce platform under their name. Their product variety includes apparel and accessories, athletic shoes, and a variety of equipment for hunting, camping, golf, tennis, fitness, roller sports, and more.

7.) Digirad Corp (NASDAQ: DRAD) – 12.4% Yield

Digirad is a healthcare solution provider. DRAD holds a portfolio of medical services and equipment and mobile healthcare solutions. Diagnostic imaging and patient monitoring tools are among the products provided to hospitals and doctor practices.

8.) Center Coast Brookfield MLP & Energy Infrastructure Fund (NYSE: CEN) – 13.0% Yield

Center Coast Brookfield MLP & Energy Infrastructure was created as a statutory trust pursuant to a Certificate of Trust. The company falls under the jurisdiction of the state of Delaware. CEN’s investment goal is to give large returns to shareholders.

9.) AH Belo Corp (NYSE: AHC) – 7.3% yield

Belo Corp is a publishing company that specializes in news and information. They possess direct mail, distribution, and commercial printing capabilities in addition to resources for digital marketing and emerging media. AHC publishes several big newspapers such as The Dallas Morning News and The Denton Record-Chronicle.

10.) Clearbridge American Energy MLP Fund Inc (NYSE: CBA) – 9.7% yield

Top 10 Best Cheap Stocks Of 2018 Summarized

In short, there are many cheap stocks to choose from in 2018. Here we have covered just five of the best cheap penny stocks and five of the best cheap dividend stocks. Keep in mind that things can change quickly when it comes to cheap stocks. By the time you read this, something may have already changed, so be sure to conduct your own research before making any real decisions.

Cheap penny stocks tend to trade on technical indicators. This is due to the self-fulfilling nature of support and resistance levels along with many other mathematical trends such as Bollinger Bands, Fibonacci retracement levels, various types of moving averages, and so on.

Because all traders have access to the same information (assuming there’s no insider trading going on), they tend to make similar decisions in unison. For example, if a cheap stock is falling and approaches a support level established last year, many traders might buy shares just before it hits that price.

This creates a self-fulfilling prophecy whereby the trends predicted by technical analysis wind up becoming true regardless of other factors. While it’s not a 100% surefire method of predicting price action, it is the most tried and true method used by most traders.

Dividend stocks are more about fundamentals. Shareholders of stocks that yield dividends want to know more about the company’s activities and management than anything else. Data points like corporate earnings, annual revenue growth, and hiring trends within a company are common parts of this equation.

Because shareholders receive dividends no matter what the price of a stock does, they’re more concerned with a company staying afloat than anything else. While technical indicators still apply in the short term, those who hold a dividend stock for the annual or quarterly dividend yields aren’t concerned with short-term trends.

Another noteworthy fact involves what’s known as high-frequency trading algorithms. In 2010, Wired magazine reported that as much as 70% of all trading volume on Wall Street is the result of sophisticated computer bots executing thousands of trades per day at super-fast speeds.

Programmers have managed to create artificial intelligence bots that read every word of every Dow Jones story that gets published on a particular day. The bots contextualize the relevant information and use it to make trading decisions based on which way the news is likely to move the market.

So, in order to make the best decisions about cheap stocks, be sure to read up on any interesting news pieces that have recently been published about the company you’re interested in. There’s a high likelihood that some high-frequency trading algorithms have a hand in moving any given stock’s price action.

Leave a Reply