Image from Pixabay

Are you ready to jump into the world of investing? Are you already investing but looking to improve your knowledge on the subject and, in turn, improve the performance of your investment decisions?

Look online for investing advice and you will be hit with a mountain of tips and tricks.

There are investing books, blogs, forums, and groups that all make various promises about investing. Of course, you only have limited time to spend on learning and research.

Image from Pixabay

If you tried to read every resource out there, then you would spend the rest of your life reading and no time actually investing.

There’s also the question of which resources actually offer benefit to the reader and which ones are simply get-rich-quick schemes wrapped up in a different package.

Spending your time reading the wrong resources could have similar effects to doing no research at all. We wanted to help you wade through the glitzy promises, the stylish covers, and the marketing lingo to find the best investing books you can dive into now.

Our Top 10 Picks for Best Investing Books

This list will give you a great starting point no matter how experienced an investor you may be.

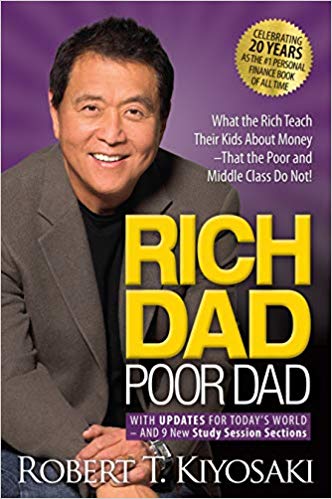

Image from Amazon

The first book on our list isn’t just about investing and, yet, it may be one of the best investing books you can read. Beginners should take a special interest in Rich Dad Poor Dad.

Robert Kiyosaki outlines the importance of financial literacy, saving, and investing. He emphasizes throughout the book the concept of paying yourself first. Essentially, he believes that people should always dedicate money to saving or investing, even if the amount seems small and insignificant.

In the book, Robert Kiyosaki gives a unique, personal look at many investing concepts that are widely regarded as smart investing strategies. For example, “pay yourself first” is basically another way of explaining dollar cost averaging.

By reading this book you will learn more about investing concepts, personal finance topics, and how someone was able to build a successful life for their family by using these simple, easy-to-digest ideas.

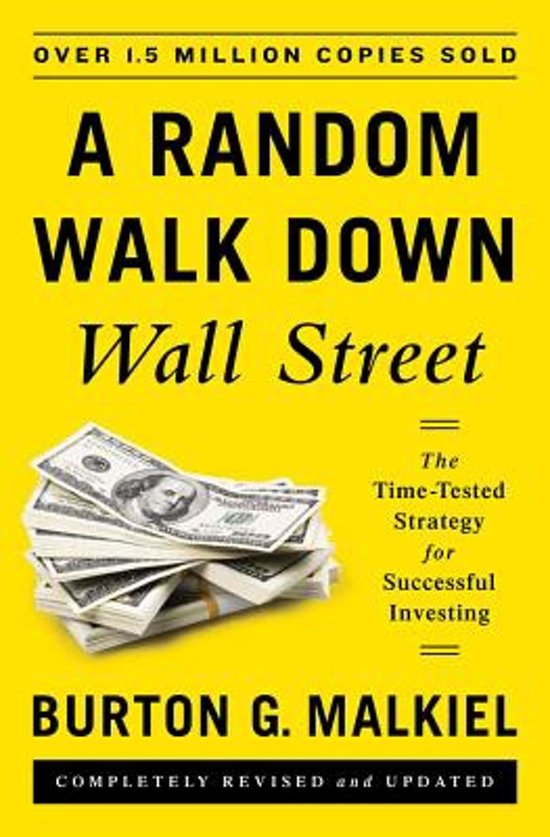

Image from Amazon

This is another great book for beginners who are ready to dip their feet into investing but may be turned off by the phrases and concepts that seem almost foreign.

A Random Walk Down Wall Street puts investing concepts in relatable terms. Chances are that you are simply looking for a way to build for your future through investing. This book educates readers about how to avoid the schemes and ridiculous sales pitches with basic investing literacy.

After reading A Random Walk Down Wall Street, you should understand investing concepts more clearly and have a better grasp on your own investing goals. Most importantly, you will be able to understand the path that takes you from your first investment to a successful retirement.

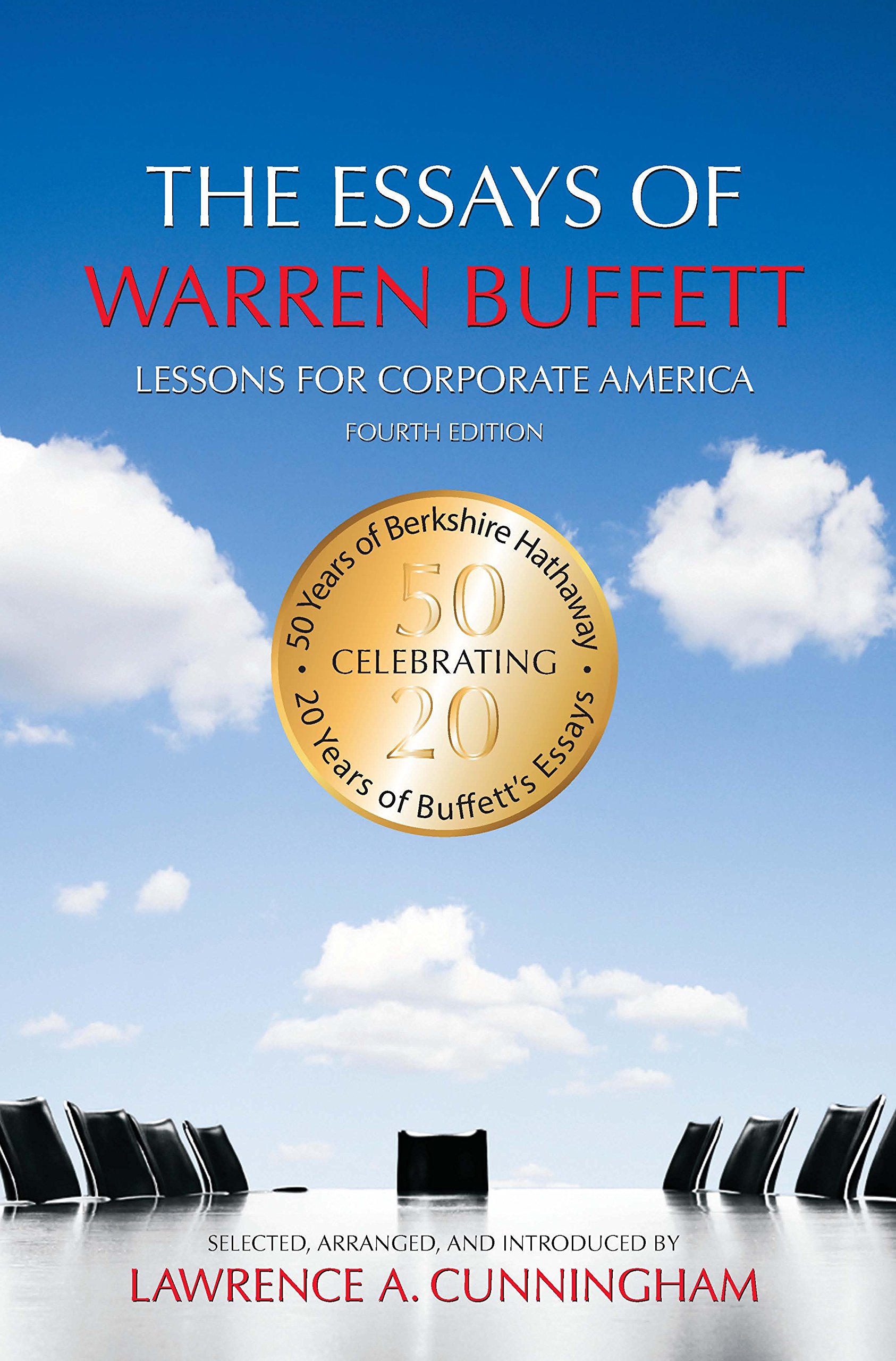

Image from Amazon

You want to learn about investing? Why not learn from the best investor there is. Warren Buffett is such a figure in the investing community that his actions can change the way the market behaves in the blink of an eye.

The story of Warren Buffett and his massive conglomerate, Berkshire Hathaway, is nothing short of incredible. The company actually began as two companies, both cotton mills. In the 1960’s, Warren Buffett took control of Berkshire Hathaway as it struggled to remain relevant. Since then, he has invested in businesses like Geico, Coca-Cola, and Apple.

In the 1980’s, investors could buy Berkshire Hathaway shares for $275. Today, a single Class A Berkshire Hathaway share trades for over $300,000. There is, quite simply, no comparison to the great mind of Warren Buffett.

Getting a glimpse into the investing style of Warren Buffett is a great place for any investor to begin their education journey. See what Buffett looks for when seeking to invest in a company and the thought process that goes into all of his investment decisions.

Image from Amazon

At the beginning of this article we promised no glitzy sales pitches with ridiculous promises. So a book with this title would seem to be out of place on our sensible list, wouldn’t it?

While the title may seem flashy like a bag of magic beans, Joel Greenblatt provides a very simple formula for identifying companies that has outperformed the market for years. Not only can investors learn how to identify the companies that will earn them sizeable returns, but the formula for building their portfolio is clearly laid out.

To put things simply, Joel Greenblatt advocates buying strong companies with good performance at an affordable price. That seems like a no-brainer, right? The art is in identifying these companies and the strategy as a whole.

The title of this book may seem like the contents within are too good to be true. As they say, never judge a book by its cover.

Image from Amazon

When you think of wealth accumulation, you likely think of incredibly wealthy people flying on private jets and vacationing on their luxury yachts. The truth is that middle class families are the best at accumulating wealth, according to this book.

Like Rich Dad Poor Dad, The Millionaire Next Door covers a lot of topics beyond just investing. Personal finance is a major focus of the book along with investing and strategies that help people accumulate wealth faster than their peers who may live in similar situations, work similar jobs, and have similar backgrounds.

Much of the book discusses how small decisions can have major impacts down the road. For example, the author discusses the opportunity cost of choosing to smoke a pack of cigarettes per day instead of investing that money.

There are some legitimate criticisms of the book. The author makes assumptions that people would invest wisely instead of spending money on habits like smoking or drinking. In addition, many believe that the author conveniently ignores those in the middle class who have attempted to accumulate wealth and failed.

Even with those criticisms in mind, the concepts put forth in The Millionaire Next Door makes it one of the best investing books you can read.

Image from Amazon

The Intelligent Investor comes recommended by people like Warren Buffett and Joel Greenblatt who, as you have noticed, are also featured on this list. That kind of praise alone makes this one of the best investing books you can read.

When reading The Intelligent Investor, you may notice a lack of excitement building inside you about investing. This is somewhat by design. Benjamin Graham did not write this book to convince people they could make millions in the stock market. Rather, he educates readers on how to research companies and invest for the long term.

Over the years, The Intelligent Investor has been revised several times. Warren Buffett says that chapter 8 and chapter 20 is the basis of his investing philosophy. Many other top investors continue to recommend this book today, which is a testament to the quality advice that Benjamin Graham originally published in the 1940’s.

Image from Amazon

As you may have gathered, investing is not an exact science. There is no simple formula that all investors follow to build their wealth. In Market Wizards, Jack Schwager interviews many of the top traders to get their opinions and insights regarding investing.

This is an important book to read for new investors because it sheds light on the wide range of strategies that investors can employ to reach various goals. Are you investing for rapid growth? Are you investing for a long term goal like retirement?

Most importantly, Market Wizards allows readers to tap into many great minds at once rather than just one. Through compelling interviews, Jack Schwager brings complex investing topics to the masses which is why his book makes our list of best investing books.

Image from Amazon

The title of this book is bold considering the incredible investing books we have listed already. However, there are so many tips packed into this book by Andrew Tobias that you will certainly be able to gain a very strong understanding of investing by reading it cover to cover.

Even if you only have a small amount of money to invest, this guide can help you make the most of your investment in order to build a strong financial future. Best of all, Andrew Tobias takes complex investing topics and explains them with humor in a way that even the most beginner investors can understand.

Perhaps the most important aspect of this book is how the concept of personal finance and saving is tied into investing. The author clearly explains how the two ideas tie together. Without savings, you simply cannot invest and this book should help you gain a better grasp over both.

Image from Amazon

Many people call what Warren Buffett does, “value investing.” This book seeks to explain the strategy employed by Buffett and other top investors in a way that beginners can also understand and begin using themselves.

Bruce Greenwald shows why value investing concepts have withstood the test of time. A lot of people believe that Value Investing is an essential follow up read to The Intelligent Investor which we mentioned above. With these two books, beginner investors can gain a wealth of knowledge from two of the greatest investing minds the world has ever known.

What’s even more impressive is that many people comment that this book is a regular staple in their rotation of reading. Investors will continue to re-read Value Investing as a sort of refresher to remind them what makes a successful investment.

Along with The Intelligent Investor, Value Investing is one of the most essential investing books you must read if you simply don’t have time to browse every title in this list.

Image from Amazon

Too many people think that they can outsmart the market or other investors. They make risky investments, lose money, and are turned off the idea of investing forever.

In this book, John Bogle covers common sense investment strategies to help people build wealth in the stock market.

None of the tactics outlined in this book are sexy. Nothing will make you 1000% profit year over year. Instead, reading The Little Book of Common Sense Investing will keep you grounded and focused on realistic investment goals. Building wealth through investing can be done but it takes time and good decision making skills.

If you have a fear of investing because of the thought you could lose your savings then this book should appeal to you. After reading John Bogle’s book you should feel confident that smart investing is the best way to build wealth for yourself and your family.

Never Stop Learning

This list of the best investing books is a great place for any investor to begin creating their own personal reading list. Some books dive deep into specific investment topics while others loop in personal finance subjects as well.

Find some of the books on this list that grab your attention and begin soaking in the wealth of knowledge these books contain. If nothing else, you will come out a more confident investor.

Of course, you never want to stop learning.

These books are just a starting point. As you dive deeper into investing you will discover new books that capture your attention. Always strive to learn more about investing while remembering the basics of successful investors.

With all of that knowledge working for you, investing will seem much less daunting and, perhaps, even downright exciting.

Leave a Reply