All You Should Know About Sensitivity Analysis

Sensitivity analysis is a very useful technique employed by business professionals in various fields. This technique is used mainly to determine the impact of different values of a specific variable on a dependent variable. This technique is incredibly useful to predict what is likely to happen in the development of a market or industry.

A global sensitivity analysis can be done by professionals who are able to interpret the evolution of a market and according to their interpretation, predict the results of a situation. Sensitivity analysis is a very challenging and difficult tool to use, as you need to be highly experienced in the field of finance.

However, when experts start compiling a sensitivity analysis model, they use specific formulas, as well as probabilistic events in order to create a realistic analysis. When we’re talking about price, sensitivity analysis is an expensive service as it requires a highly specialized expert who has to put in a lot of hours of hard work. If you want to know the benefits and also the basics of sensitivity analysis, just read through our next sections.

What is Sensitivity Analysis?

It might seem complicated to offer a sensitivity analysis definition, but in fact, it is not such a grueling task. This is a technique employed by business owners or stock market holders who want to get a forecast on what changes are going to occur in their industry. It can be used to predict the evolution of a specific business, as well as the fall of certain stock market branches.

Sensitivity analysis is a vital tool that can be efficiently used not only to predict, but also to prevent a negative outcome from happening. Business owners who invest in this type of research experience the benefits of getting a heads-up on what is about to go down in their particular sector. It is incredibly important to have access to such knowledge in order to adapt to the ever-changing free market.

Sensitivity analysis Excel format is generally the preferred software for presenting this type of document. A variety of factors are taken into account when building a sensitivity analysis, and the opinion and overview of an expert are required to create a realistic, effective result.

How to Do a Sensitivity Analysis?

Researching, creating and then presenting a comprehensive Excel sensitivity analysis is a difficult task unless you are experienced in the financial field. The purpose of this process is for the analyst to determine in what way changes in one or more variables will affect the target variable.

This means the analyst has to research and to predict two different categories of variables: the first set of changing variables and the dependent one they will eventually impact. This ability requires extensive knowledge of finance, but also a great degree of foreseeing and interpreting virtual events that haven’t occurred yet.

There are a variety of parameters that need to be studied and then interpreted to produce a good sensitivity analysis. The purpose of the analysis is to test the robustness of predicted results of a system in the unavoidable presence of real-world uncertainty.

The main concern of an analyst that attempts to create a high-quality sensitivity analysis is to provide an accurate overview of future events, by employing a sensitivity analysis formula. There are a few features that need to be researched, assessed and tested before building the sensitivity analysis in excel.

- Test the robustness of a model or system by taking into account uncertainty of certain variables

- Increase understanding of the way input variables influence the output variables of the model

- Reduce uncertainty by more in-depth, specialized research of the specific market

- Search for, identify and eliminate errors in the system

- Simplify the model by eliminating the input variables that have no influence on the output

- Communicate the results to managers and decision makers and advise them accordingly

- Calibrate models by focusing exclusively on sensitive parameters that affect the end result

There are a variety of different types of sensitivity analysis models, depending on the method employed or the end result. Price sensitivity analysis (or NPV sensitivity analysis), Sobol sensitivity analysis or Monte Carlo sensitive analysis are just a few options when it comes to building a successful risk sensitivity analysis.

Scenario Analysis Vs Sensitivity Analysis

We have already attempted to define sensitivity analysis, a complex process used by professionals to determine the outcome of a situation based on a variable number of actions. Scenario and sensitivity analysis are two different tools that serve the same purpose; identifying the most likely result after analyzing a set of variables.

Scenario analysis deals with possible future outcomes by looking at alternative results which are sometimes referred to as “alternative worlds”. Unlike one way sensitivity analysis, scenario analysis is a method of projection that doesn’t provide one sole answer, but multiple possibilities.

Using scenario analysis experts can estimate the value of a portfolio after any fixed period, by concentrating on the changes that might occur in the industry. Scenario analysis focuses on creating an estimation of the portfolio value if the worst-case situation were to happen. This is a very useful tool for predicting what the most unfavorable situation’s effects will be on the value of a specific product or service.

Variations & Uses of Sensitive Analysis

Sensitivity analysis finance is one of the most common fields where this method is used. It can also be helpful as sensitivity analysis epidemiology or sensitivity analysis accounting. There is a great selection of different methods and formulas for sensitive analysis, and they can all adapt to every industry.

As the general purpose of the sensitivity analysis is to assess possible outcomes, there are different ways to employ it for different situations. A DCF sensitivity analysis is focused on the discounted cash flow, while a sensitivity analysis NPV focuses on the net present value of a certain business.

Linear programming sensitivity analysis uses a mathematical technique that maximizes or minimizes a linear function according to a set of variables. Probabilistic sensitivity analysis, also known as PSA has an important role in determining cost effectiveness.

Sensitivity analysis Monte Carlo is a simulation method that can help decision making by showing the expected risks of an action or set of actions. It is used by experts in fields such as project management, engineering, research, insurance, and finance.

Sensitivity Analysis Example

To better understand the principles of this technique we will provide a few practical examples. When an analyst is asked to create a financial model he has to take into consideration a few factors. In order to build the sensitivity analysis, he will look at the company’s equity which is the dependent variable, and also at the specific amount of earnings which is the independent variable. The company’s yearly earnings will then be compared to the company’s price-to-earnings, which is another variable number.

The end result will be a table or an excel sheet that will present the predicted results, covering the most likely result. Probability assessment and in-depth knowledge of finance are necessary skills for anyone who wishes to have a career in sensitivity analysis.

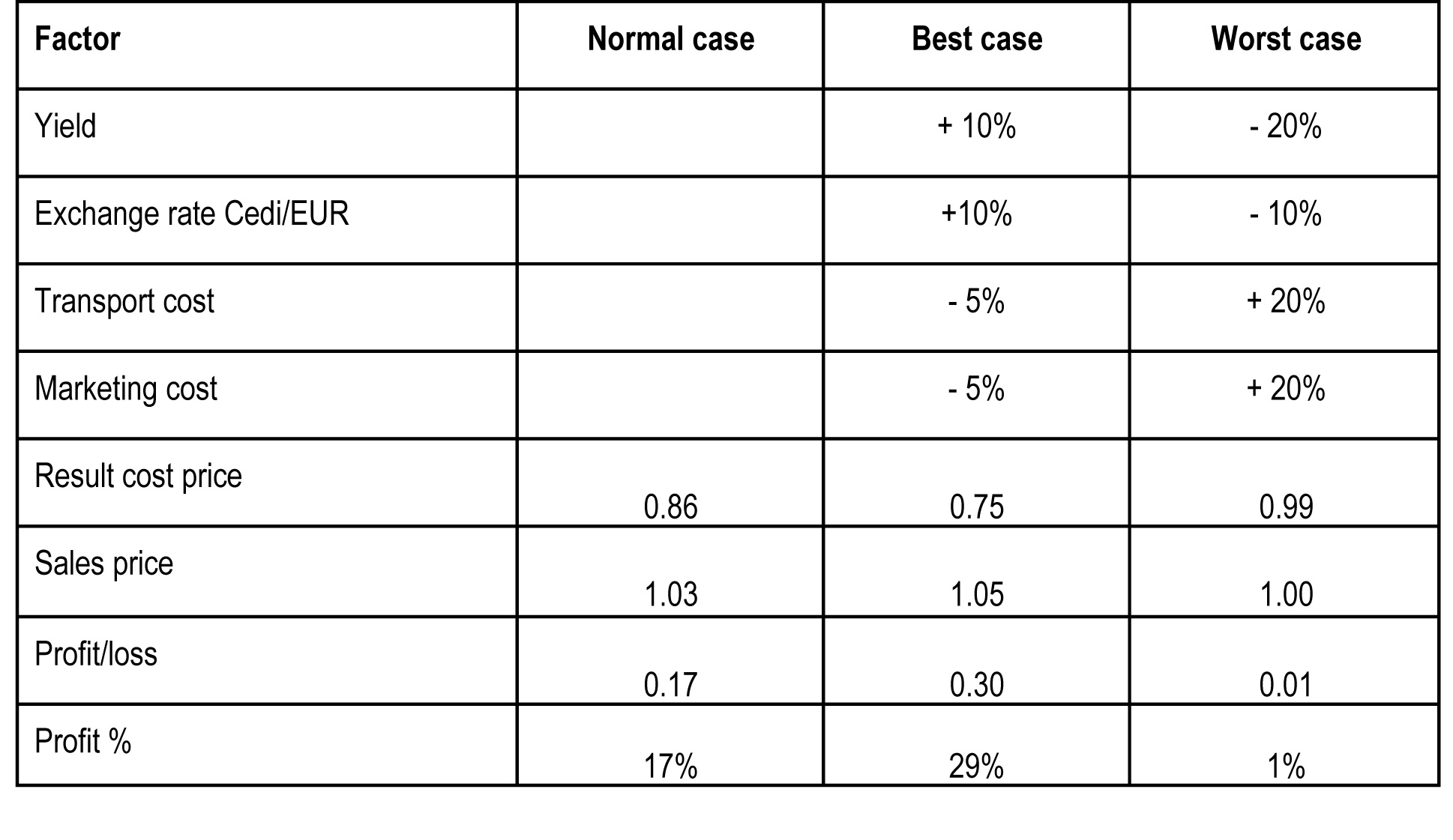

Below, you can see a simple chart that can serve as an example of how sensitivity analysis works. Keep in mind that this is a simplified version to illustrate the idea behind sensitivity analysis, and not what an expert will provide after thorough research and assessment.

Image credit: Wikimedia

In this case, we will illustrate an example of applied analysis from economics. Many variables are uncertain in the process of budgeting, which means the analyst has to predict their most likely value. Taxes, interest and inflation rates, as well as expenses cannot always be determined with a lot of precision, so the analyst provides a worst and best case scenario.

Taking into account the two possibilities, he can provide a chart or document with an overview on the outcome of the situation based on probabilistic values of specific factors. Using this tool, he can also identify the variables that have the greatest impact on the end result and concentrate on them.

Shadow price sensitivity analysis is a great way for decision makers to know what might happen in a given period of time and adjust to these discoveries. The use of any kind of sensitive analysis is to provide managers and business owners with a clear overview of the shifts that may happen in their field. This way, they can adapt and reduce costs, limiting the effects of even the most unexpected negative events.

The Importance of Sensitivity Analysis

As it was highlighted above, sensitive analysis is one of the most useful tools created to help businesses efficiently manage their costs. It is successfully employed in a variety of fields such as finance, management, engineering, and economics. Most businesses already benefit from the expertise of analysts who provide results according to a variety of determining factors.

A thorough analysis can reduce costs and increase revenues by analyzing and predicting future events. A variety of skills are required in order to build a realistic, sensitive analysis; knowledge of the field, mathematical formulas that can be employed and also a deep understanding of the specific factors that influence the outcome.

As all actions have reactions, every small variable than can have an effect on the result should be taken into account. Experts in sensitivity analysis can predict even the most unexpected events, helping managers adjust to the ever-changing reality of the financial market.

It is highly important to consider employing a sensitivity analyst when creating a business plan. Regardless of his or her fee, the investment will pay off in both short and long term, as the business will develop and become more robust and cost-effective.

Overview

There is a variety of model sensitivity analysis templates available online, but in order to obtain the best results, an expert should be contacted. They are highly trained in the field, and they will provide thorough research, as well as an effective business plan that will help any business evolve and develop.

Sensitivity analysis is not a guessing game, but a precise science that deals with mathematical formulas, probabilities and a set of identifiable variables. Although it might seem accessible and easy-to-understand, the various techniques and models for sensitivity analysis can be successfully employed only by a specialist. If you choose the services of a highly-trained, experienced professional, you will benefit from a thorough analysis that will greatly increase your profits. There is no automated sensitivity analysis calculator, and human input is vital in this field.

It is recommended to contact a sensitivity analyst even before you start your business plan, as their expertise will help you create a realistic, successful model. By decreasing risks and analyzing probable outcomes, an analyst will provide you with the best short and long-term strategies to employ in order to ensure the success of your project or business.

Conclusion

There is no point in asking why should I use sensitivity analysis, as the answer is clear. You will gain insight into your specific sector, as well as a professional overview of the possible events that might occur in the future. Using this data, you can create a business model that will prove to be efficient and successful, regardless of the shifts in the market.

Surprises are not desirable for businesses, and all business owners should know what to expect before it happened. You can’t be taken by surprise if you predict future outcomes, and sensitivity analysis is the best tool for the task. To prevent unfavorable events and adjusts to favorable ones you need to be ready and prepared ahead of time. This is the main purpose of the analysis; to offer you all the necessary tools that ensure the success of your business by reducing risks and costs.

Sensitivity analysis is the most important technique of our time and business owners from all over the world already discovered the benefits brought by using it. This financial technique is the key to ensuring the long-term success of your business or project, by decreasing costs and increasing revenue.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

As a participant in the Amazon Services LLC Associates Program, this site may earn from qualifying purchases. We may also earn commissions on purchases from other retail websites.

Find us on Facebook

Recent Posts

- Forex Indicators: 4 Indicators Investors Should Know

- Best Money Clip: 10 Options to Secure Your Cash

- What is a Savings Account? Explaining Why You Should Have One

- Clarity Money Review: A One-Stop-Shop

- What Do Investment Bankers Do? Ultimate Guide

- Top 10 Best Investing Books

- Best Bitcoin Mining Software: Top 5 Revealed

- Depreciation Methods: Our Top 4 Picks

Leave a Reply